Capayable in installments continues as in3

Pay an order online in 3 installments without spending a cent extra. That is In3, the new brand name of the payment method developed by Capayable. With a new brand name and proposition, the Eindhoven company wants to continue to grow in the payment market.

Pay an order online in 3 installments without spending a cent extra. That is In3, the new brand name of the payment method developed by Capayable. With a new brand name and proposition, the Eindhoven company wants to continue to grow in the payment market.

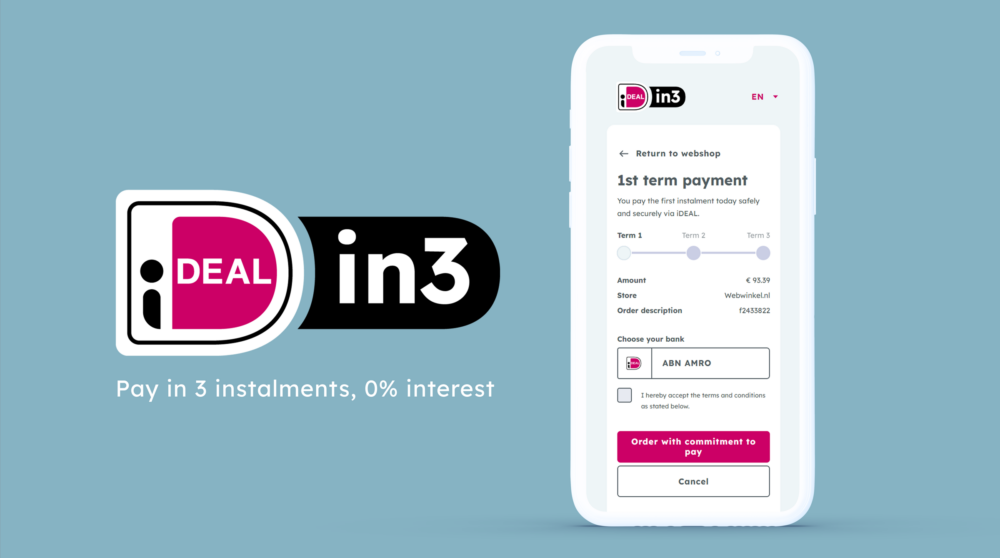

On September 18, Capayable is launching the new brand name In3 for the payment option in installments. The In3 payment method offers online shoppers the opportunity to pay securely in 3 installments at zero interest. With In3, Capayable wants to grow into a standard payment solution in every webshop.

New brand

Patrick van de Graaf, director at Capayable, about the new brand: ”From a marketing point of view, with In3 we have a more powerful brand in the payments market. It says exactly what it stands for. In the beginning, we communicated with payment in installments, which consumers associated with long maturities, high interest rates and BKR registrations. That is not the case with us. We like to keep it simple and clear, hence the name change. We have opted for a fresh and striking house style to be extra distinctive. As an innovative payment method, we also want to be at the forefront of this.”

In3

How does it work? On the checkout page of a web store, the consumer chooses the payment option In3. The consumer immediately pays the first installment via iDEAL. The second and third installments are paid by the customer within 30 and 60 days respectively. To prevent irresponsible purchases, In3 performs a data check within a split second. The data check is based on socio-demographic factors in combination with past payment experiences. The payment solution accepts orders from €100 to €3,000.

New proposition

The web retailer is unburdened throughout the entire process, because In3 immediately takes over the invoice. For example, the online retailer is paid within 15 days and the risk is taken off your hands. In particular, the threshold for more expensive products is significantly lowered.

Patrick van de Graaf: “Internal research shows that by offering the staggered payment option, the conversion increases on average by 15% at online stores and the average order amount can rise to 30%. With In3, online stores have an extra marketing tool to increase sales.”