Paying in 3 installments leads to 72% higher transaction value: study

Consumers spend on average 72% more per e-commerce transaction if they can pay in installments, according to a recent study from Erasmus University Rotterdam (EUR). The study investigated a short-term form of credit where consumers pay in three installments without interest.

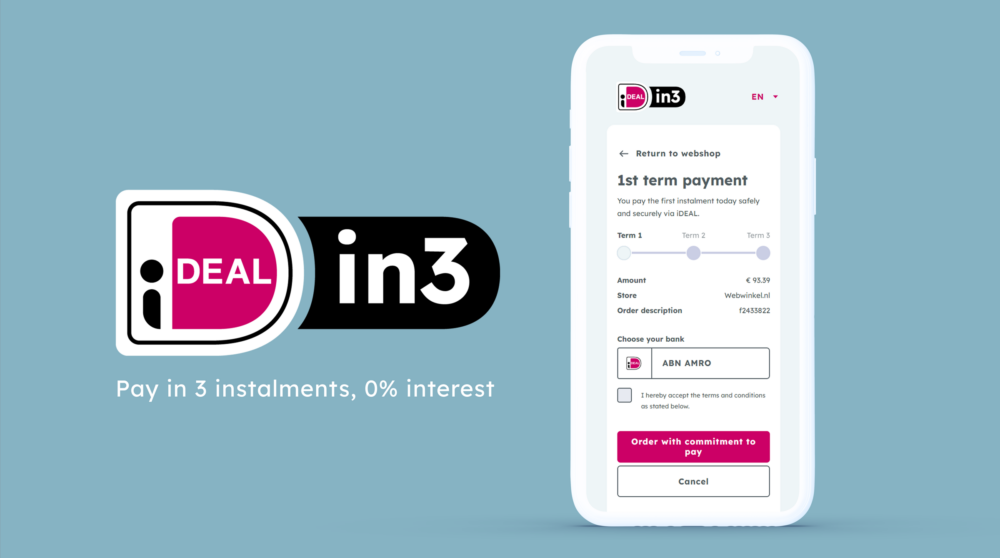

Data for the study “Buy now, pay later in the 21st century” was collected by Magellaan van Rensbergen, a master student at EUR, in collaboration with Dutch Buy Now Pay Later (BNPL) provider in3. The study investigated hundreds of thousands of orders to compare the payment method offered by in3 to other payment methods such as iDEAL, credit cards, debit cards and Paypal.

The research shows that consumers who pay with in3 have a significantly higher average order value (€ 657,20 vs € 381,20). However, consumers do not purchase more items per order. This is an important finding as it could indicate that consumers use BNPL to purchase higher-value items instead of more items.

Growing market

The use of Buy Now Pay Later payment methods is growing rapidly in the Netherlands. It is expected the market size will increase from $7.9 billion in 2021 to reach $43.6 billion in 2028. There is little recent research on the effect of BNPL on consumer spending, the most notable studies in this field dating from the 1970s and 80s. These studies, based on the US market, conclude that people who use credit cards are more likely to make large purchases. Credit also increases the willingness to pay, the time to pay, and the size of the purchases.

Hans Langenhuizen CEO of in3 responds: “This new study shows the value of BNPL solutions. While we knew the average order value would be more when choosing in3, we didn’t expect the difference between our payment method and other payment methods would be that much. It’s great to see that our social responsible approach pays off.”

The outcomes of the study are of interest to merchants as well. Adding a BNPL option can lead to a higher average transaction value and to new customers. A case in point is Furnea, a Dutch online store in home and living products. Since adding in3 to its payment options it is now the most used post-payment method: about 20% of all transactions go through in3. Kenan Aslan, CEO of Furnea explains: “I think that more than half of all orders would not be placed if it were not possible to pay with in3. It is also clear that these orders have a higher average order amounts. in3 is mainly used for purchases over € 300. We notice that customers are more likely to buy products with a higher price when they realise they can pay in instalments. in3 therefore ensures a higher conversion for us.”

Economic sense

In the study, several e-commerce companies are selected based on the number of transactions they process, the product segment they are operating in and the variety of products. The respective e-commerce companies involved provided payment data operate in either one of the following categories: furniture or consumer electronics (tablets, phones, chargers, televisions) and are focusing mainly on the Dutch market. The study suggests that the effect of the use of in3 increases when it is straightforward for consumers what the more premium product is and they can easily see the benefits. That’s the reason online stores use price comparison options. A good example is appliances, where the cheaper version of a washing machine often has a higher energy consumption than the more expensive version. When the added value of buying a more expensive item is very clear, a BNPL solution like in3 makes economic sense for consumers.